Veterans receiving invalidity benefits from their military superannuation schemes were wrongly taxed for years according to a decision handed down in the Administrative Appeals Tribunal by Justice Logan in precedent setting test cases on Wednesday 25 March 2020.

Veterans who are medically discharged from the ADF may receive a disability benefit from their military superannuation equivalent to the benefits paid to other similarly disabled Australians from the insurance component of their superannuation.

But the ATO taxed the veterans differently, and the Commonwealth Superannuation Corporation (CSC), which reported the benefits to the ATO, were unable or unwilling to answer the veterans’ question: “What law are you applying to my Invalidity Benefit?”

The ATO and CSC could not answer because there was no applicable law. This ruling recognises that these were “disability superannuation benefits” and should be taxed on the same basis as for other disabled Australians. Hundreds of veterans, many discharged with mental health issues, have endured this discrimination and mistreatment for years.

DFWA calls on the government to do the right thing.

• Respect the judgement. Don’t cause further distress by appealing.

• Refund what is owed to all veterans promptly, including those who trusted you and did not lodge individual objections. These were test cases.

• No spin about loopholes. No retrospective changes to the law.

In the words of the Australian Veterans’ Recognition (Putting Veterans and their Families First) Bill 2019 that legislated the Veterans’ Covenant, be “sensitive to any physical or mental injury or disease they may have suffered and respect their military service.”

DFWA pays tribute to those veterans and their families who have endured the stress and the personal costs of being Test Cases for your mates.

DFWA also extends thanks to the legal team, Dan Paratore and Phil Hack, both ADF veterans, who went above and beyond. WFD.

Contacts

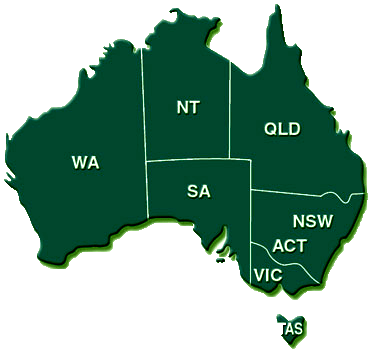

National President: Kel Ryan (0418) 759 120 www.dfwa.org.au

Queensland President: John Lowis (02) 5104 3106

DFWA – Voice of the Defence Community

1. Defence Force Retirement and Death Benefits (DFRDB) scheme and the Military Superannuation Benefits Scheme (MSBS)

2. Wayne Douglas vs Commissioner of Taxation. Brisbane AAT 2016/6964 and 6965; Peter Burns vs Commissioner of Taxation 2017/1647-1549 and 2017/1663