THOSE who are addicted to Royal Commissions as universal panacea to perceived wrong should be watching the Financial Services Royal Commission with close interest.

THOSE who are addicted to Royal Commissions as universal panacea to perceived wrong should be watching the Financial Services Royal Commission with close interest.

The FSRC is enquiring into dodgy practices employed by banks to rip off their customers.

Among the practices under the commission’s microscope are such things as excessive fees and charges.

They are also probing ancillary services aggressively promoted by banks which are both expensive and usually unnecessary.

They do however boost banks’ profits and occasionally bonuses paid to employees to promote them.

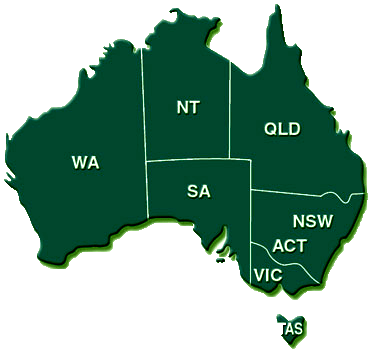

Banks have always played an important role in military life, particularly when peripatetic lifestyles involved frequent moves between different localities.

Even when ADF members were required to receive a portion of fortnightly salaries in cash, an allotment could be made to an appropriate financial institution to provide for savings and also periodic payments by cheque.

There was a time before cash cards and internet banking when a personal relationship with the local manager of your preferred financial institution was essential.

One of the first tasks on assuming a new posting was a visit to the local branch of your bank to meet the manager and staff to set up a new account, arranging for the remnants of your previous account to be transferred across.

A sympathetic manager would invariably contact you when things inadvertently went awry while the matter was sorted.

It was civilised but more importantly it was personal.

The advent of ADF themed credit unions, some now banks in their own right created an even more convenient service.

It helped having a financial institution sympathetic to the unique demands of service life.

By establishing a personal relationship with the staff of the local credit union branch, ADF personnel discovered when detached or posted away they could arrange essential financial transactions by a simple phone call.

It also eliminated the need to transfer accounts from one branch to another on each posting.

However there is one aspect of defence related banking which could possibly excite the FSRC interest.

There was a time when what were called War Service Home Loans were made available to eligible veterans at interest rates below standard market rates.

These modest loans allowed veterans to purchase a home without many of the restrictions applying to standard bank loans.

More importantly the scheme was administered by bureaucrats within the Repatriation Department, later the Department of Veterans’ Affairs, so loans did not attract the fees and charges which applied to bank loans.

The scheme has been modified several times, but there was a period when it was contracted out to one of the major banks.

Interest rates were not as attractive as the original scheme and the bank added several fees and charges, plus ancillary services which created increased costs above those associated with the original scheme.

These simply lifted the effective interest rate on the loan by the same deceptive practices which are now being exposed at the FSRC.

This column originally appeared in The Townsville Bulletin